Roth ira contribution calculator 2021

Choose the appropriate calculator below to compare saving in a 401 k account vs. Roth Ira Contribution Limit 2021 Calculator.

Historical Roth Ira Contribution Limits Since The Beginning

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security.

. The amount you will contribute to your Roth IRA each year. Ad Do Your Investments Align with Your Goals. 9 rows Amount of Roth IRA Contributions That You Can Make For 2021 This.

Full contribution if MAGI is less than 125000 single or 198000 joint Partial contribution if. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Ad Explore Your Choices For Your IRA.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the total contributed to all Traditional andor Roth IRAs totals no more than 6000.

Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Learn About 2021 IRA Contribution Limits.

For 2021 and 2022 the most you can contribute to Roth and traditional IRAs is as follows. You can contribute to a roth ira if your adjusted gross income is the tools and information on this webpage permit you to view ira. Get Up To 600 When Funding A New IRA.

Roth IRA Contribution Calculator - GEBA Government Employees Benefit Association Tax Year 2020 2021 Tax Filing Status Individual Married filing jointly Married filing separately Age Group. For the tax year 2021 the top-end income limits. Open A Roth IRA Today.

6000 if youre younger than 50 7000 if youre age 50 and up 3 Roth IRAs have an. This calculator assumes that you make your contribution at the beginning of each year. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually.

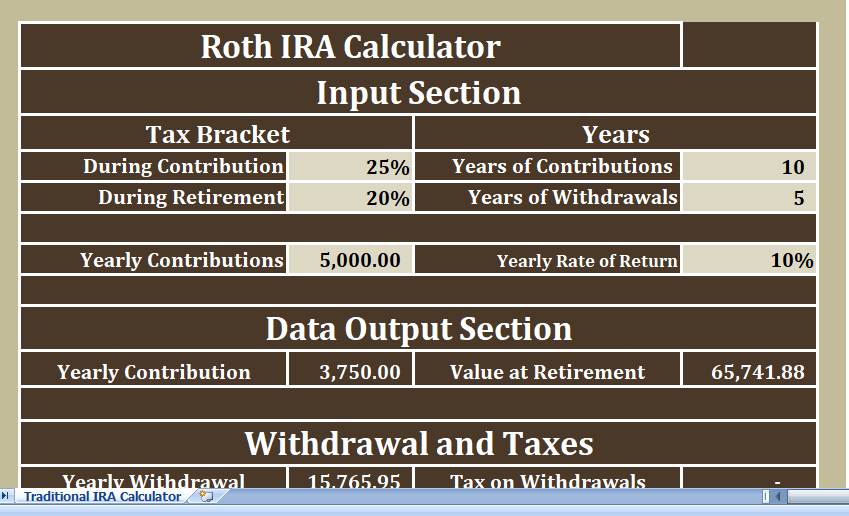

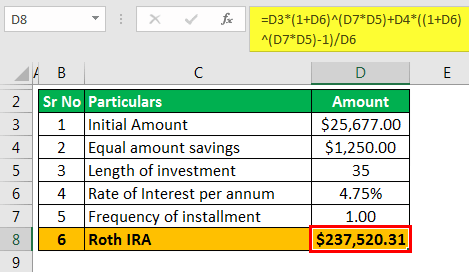

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Roth IRA Calculator Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. The amount you will contribute to your Roth IRA each year.

It is important to. This calculator assumes that you make your contribution at the beginning of each year. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options.

For comparison purposes Roth IRA. During the 2021 tax year your Roth IRA contribution is phased out based on MAGI. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

128000 128000 125000 3000 3000 15000 02 02 6000 1200 6000 1200 4800 Using the example information above the calculated. Contributions are made with after-tax dollars. We Go Further Today To Help You Retire Tomorrow.

Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. You can adjust that contribution. For 2022 the maximum annual IRA.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. It is mainly intended for use by US. Explore Choices For Your IRA Now.

Ad Learn About 2021 IRA Contribution Limits. You can contribute to a Roth IRA if your Adjusted Gross Income is. The amount you will contribute to your Roth IRA each year.

Get Up To 600 When Funding A New IRA. This calculator assumes that you make your contribution at the beginning of each year. Depending on the filing status adjusted gross income AGI and Roth IRA contribution the credit can be up to 2000.

Ad Use Our Calculator To Help Determine How Much You Are Eligible To Contribute To An IRA. Less than 140000 single filer Less than 208000 joint filer Less than. Find a Dedicated Financial Advisor Now.

We Go Further Today To Help You Retire Tomorrow. Roth IRA annual contribution limits in 2023 will likely rise more than they did from the taxable compensation limits of 2021. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

If you are below the Roth IRA income limits in 2022. For 2022 the maximum annual IRA. For 2022 the maximum annual IRA.

This calculator assumes that you make your contribution at the beginning of each year. Open A Roth IRA Today. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need.

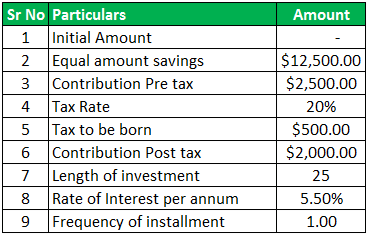

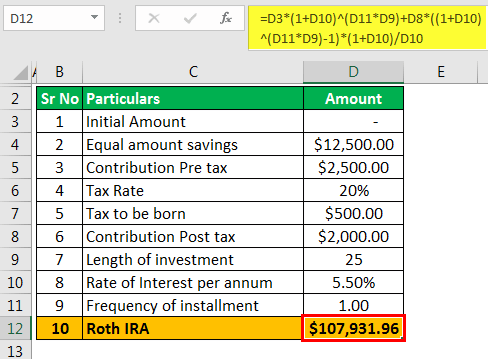

Roth Ira Calculator Excel Template For Free

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Strata Trust Company On Twitter Use This Roth Ira Calculator To Compare The Roth Ira To An Ordinary Taxable Investment Https T Co Zkaxyfaumr Retirementplanning Https T Co 5hzwv5jvbl Twitter

Roth Ira Calculator Calculate Tax Free Amount At Retirement

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Nerdwallet Roth Ira Calculator Results Explained With Examples 2022 Youtube

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

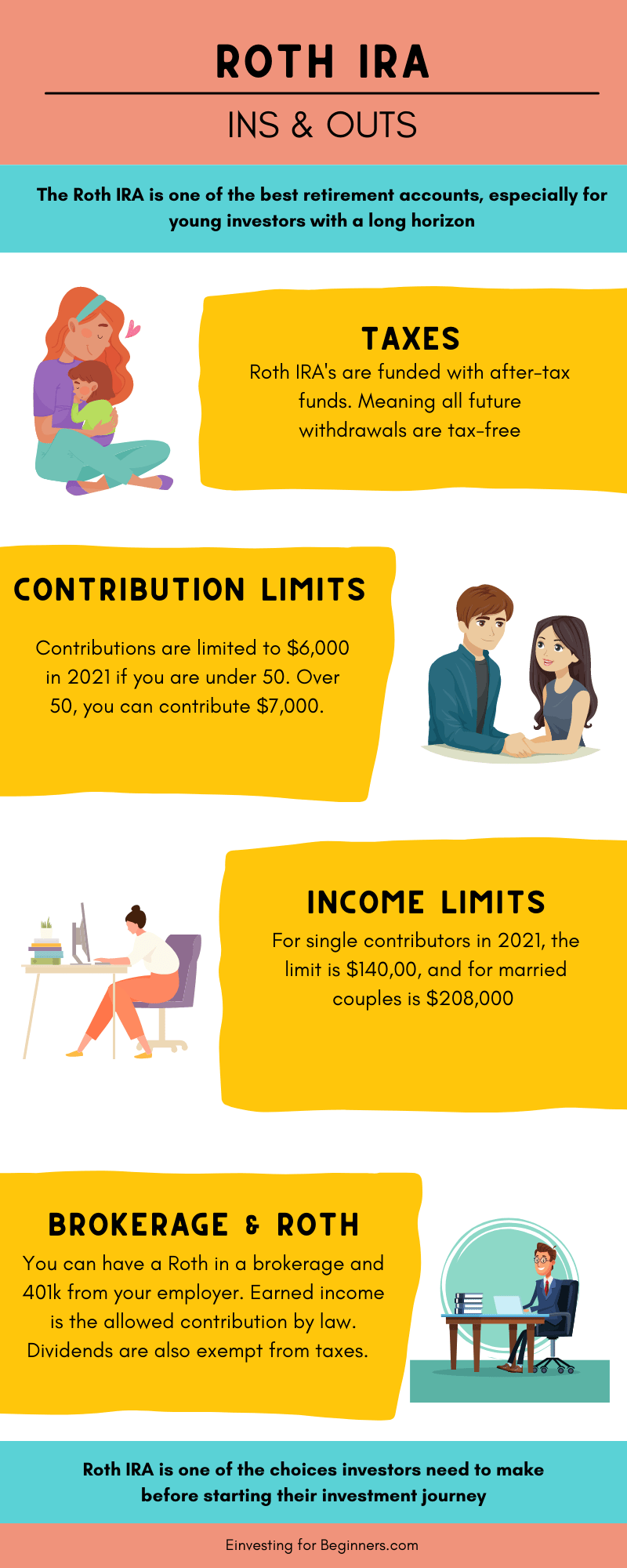

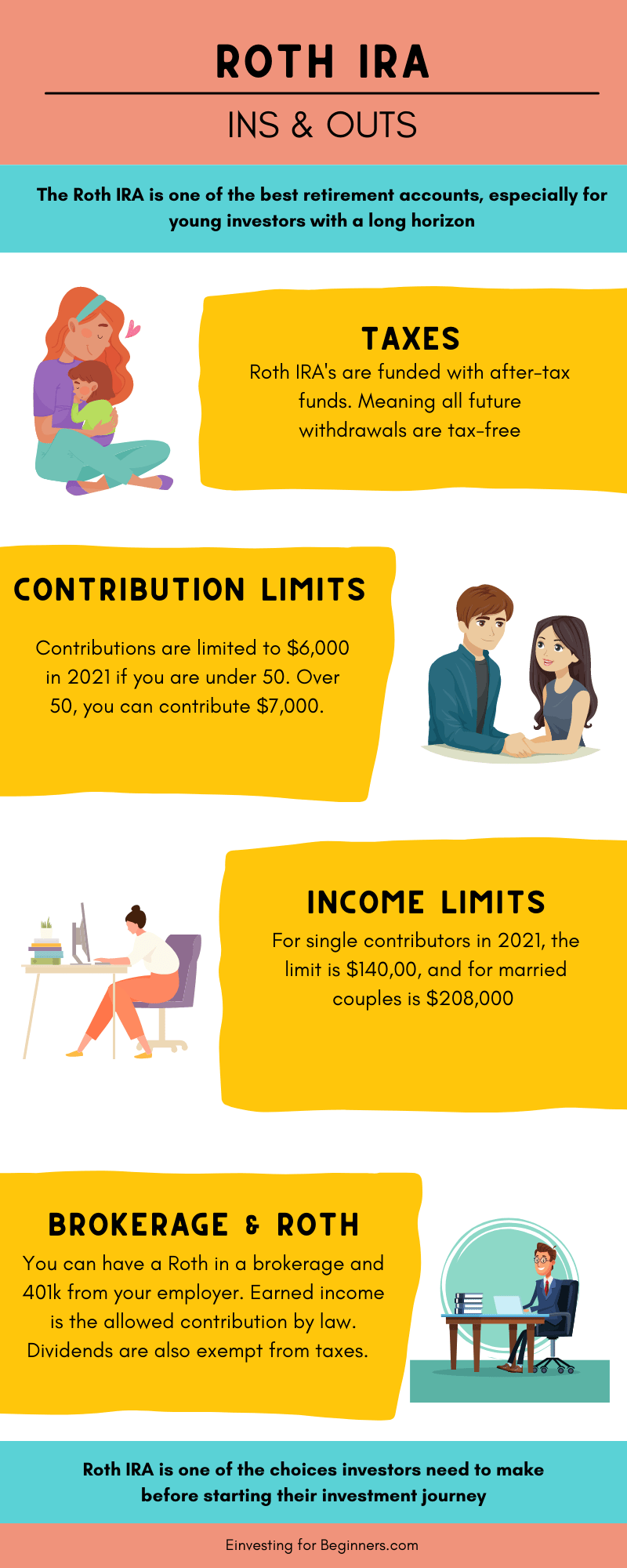

Roth Ira Taxes Limits And Options Infographic

Roth Ira What It Is And How It Works Nextadvisor With Time

Contributing To Your Ira Start Early Know Your Limits Fidelity

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth